2022 was a typical rainy and farming season in Northeast Nigeria, including the BAYG States (Borno, Adamawa, Yobe and Gombe). As usual, Smallholder farmers (SHFs) were busy tending to their crops, hoping for a bountiful harvest. However, little did they know that disaster was lurking around the corner.

As the rains intensified, floods swept through the region, leaving a trail of destruction in its wake. While some SHFs had their farmlands submerged, others had their crops destroyed, and the farmers were left with nothing but despair. It was a devastating blow to the already vulnerable region. It has been a recurrent feature in the North East. For instance, a GazetteNG report in 2022 has this as the headline: North-east farmers count losses as floods ravage 150,000 hectares of farmlands.

Garba Gasika, a maize farmer, is a member of Hirzi Farmers Association in Marama village, Hawul LGA of Borno State. Garba and members of the association were not left out of the destruction that surged through the communities during the rainy season of 2022. “2022 was not a good year for farmers, because after planting, a downpour happened and ‘cleared’ our farms. It had a huge negative impact on our expected yield,” lamented Garba.

Garba’s 50-member group and several other SHFs in the Northeast were faced with the daunting challenge of producing food in the face of unpredictable and adverse climate conditions. However, amidst the chaos, there was a glimmer of hope through the USAID-funded Feed the Future Nigeria Rural Resilience Activity (RRA) implemented by Mercy Corps Nigeria (MCN). The Activity has come to the rescue of 299 smallholder farmers in the BAYG states.

The story started earlier in 2022, when Diamond Development Initiatives (DDI), one of the NGOs implementing the RRA in the Northeastern states, worked with Pula Advisors to provide insurance coverage to some farmers under the RRA. Even though the number of farmers who subscribe to Agric Insurance is disturbingly low in Nigeria, the type of Agric Insurance developed by Pula was innovative and designed with the farmers’ interests in mind. Mrs Halima Elisha, a Maize Farmer in Biu, was the first person to register as she was taught the benefits of agric insurance. “I registered because I was taught the importance of insurance and that I would be protected from flood or any natural disaster,” explained Mrs Elisha.

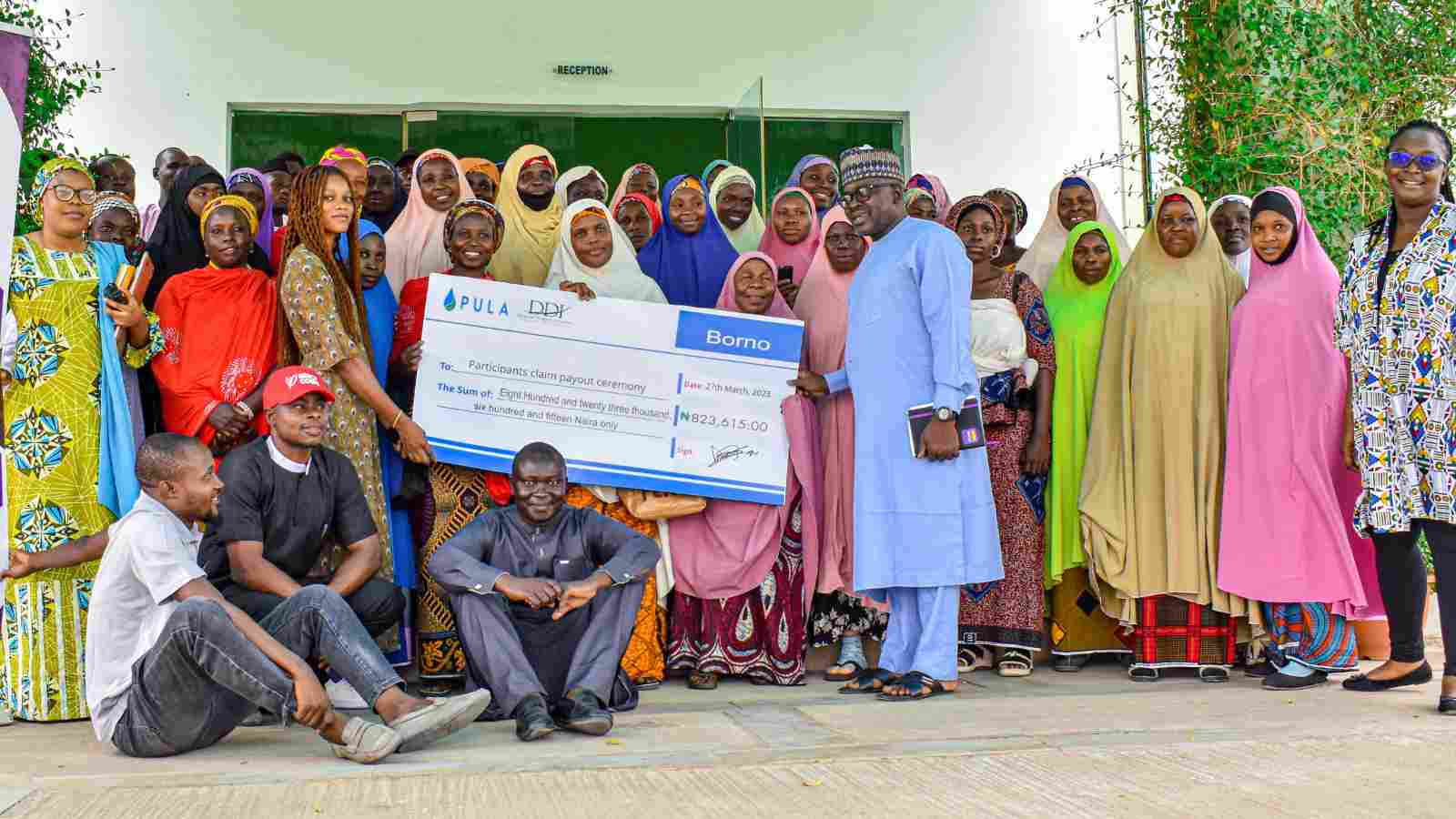

As the floodwaters receded, the Pula Advisors team swung into action, assessing the damage, and preparing a compensation plan. And on March 22 and 25, 2023, 299 SHFs under the RRA, who had purchased farmers’ insurance policies in 2022 to mitigate the effects of adverse climatic conditions on their crops, received their payout claims from Pula Advisors. The payout claims were distributed during payout ceremonies held in Yobe, Gombe and Borno States on the 21st, 22nd and 25th of March 2023 respectively. Meanwhile, eligible participants in Adamawa State are set to receive their payouts by the end of the month.

In an interview with Mrs Veronica Alex, a farmer who benefited from the payout, she expressed her gratitude to the insurance company, MCN and its partners, and DDI who made it possible for her to keep her head held high despite the disaster. “I never believed that there was something like insurance for farmers who lose their crops to floods or other natural disasters. But last year, DDI and MCN came to our community, and they sensitized us on the importance of having our farms insured. I am so grateful to them because as they have promised us during registration, they have truly come to fulfil their promise,” enthused Mrs. Alex during the payout ceremony in Biu, Borno State.

For these smallholder farmers in the BAYG states, the RRA project has been a lifeline. It has provided them with the support they needed to recover from the flood and rebuild their livelihoods. With the help of Mercy Corps Nigeria and DDI, they are able to overcome challenges and emerge stronger and more resilient. The RRA is indeed facilitating economic recovery and growth in vulnerable, conflict-affected areas in the Northeast.

This payout ceremony has further deepened the trust of rural farmers in Agric Insurance. It has demonstrated the effectiveness of investing in farmers’ insurance to safeguard smallholder farmers from the devastating effects of climate change. As a result, these farmers can reinvest the money they receive from their claims into their farms, families, and communities, improving their resilience to future climatic shocks.